Trusted by 50+ AMCs such as

Industry’s leading accuracy for all Appraisal Management Companies’ appraisal modernization needs

Data Collection completed by realtors and information verified with 3D tour technology

Data Collection completed by realtors and information verified with 3D tour technology

Our cutting-edge 3D tour technology provides accurate and detailed GLA floor plans, ensuring quality and accuracy in every collection.

3D Tour

Interactive 3D views of every accessible interior space and the exteriors.

2D Floor Plan with GLA

ANSI compliant 2D floor plan with exterior walls and gross living area (GLA) calculation within 2% to 6% margin of error.

Labeled Property Photos

Photos of all interior rooms and exterior of the properties plus street views

3D Tour

Interactive 3D views of every accessible interior space and the exteriors.

2D Floor Plan with GLA

ANSI compliant 2D floor plan with exterior walls and gross living area (GLA) calculation within 2% to 6% margin of error.

Labeled Property Photos

Photos of all interior rooms and exterior of the properties plus street views

View Sample Reports

Asteroom always delivers two reports to meet both GSE’s data standards to you achieve fungibility

View Sample Reports

Asteroom always delivers two reports to meet both GSE’s data standards to you achieve fungibility

Contact sales

Contact sales

Why is Asteroom Trusted by 50+ Leading AMCs?

Our superior technology results in the most accurate, comprehensive, and fastest reports nationwide.

Increased Speed

Increased Speed

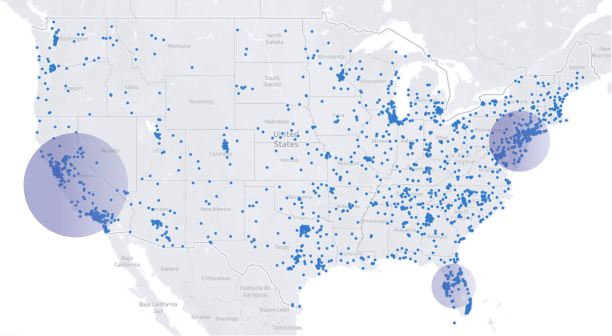

Our network can reach 95% of the population within one calendar day with the data returned or submitted to the GSE in under 48 hours.

Extremely Accurate

Extremely Accurate

Leveraging Asteroom's proprietary 3D tour technology that creates a digital twin of the subject property all data points are verified in our 3-step quality control process resulting in less than 5% revision rate request.

Dependable Network

Dependable Network

Asteroom's network of data collectors consists of over 5,000 active realtors who are best suited for easy access to the properties and have high professional etiquette.

How Asteroom's Data Collection Process Works

Day 1

Order and scan

After an order is placed, a certified real estate agent in our network who will work with the onsite contact to scan the property and collect data on day 1 in the afternoon if possible.

Overnight

Data is processed

All the data collected will then be processed and reviewed by our quality assurance team who will use the 3D tour to double-check the answers provided by the onsite agents.

Day 2

Delivery

Once the final quality assurance review is completed, Asteroom will deliver all assets back to you or submit them to the GSE on your behalf via API. You may also use a dashboard to monitor the order progress and download all the deliverables.

Data Collection Services Overview

Desktop Appraisal

Services included:

Data collection service in all 50 states

360 room by room navigation tour

3D dollhouse

ANSI Compliant 2D floor plan with GLA

Basic Report

Fannie Mae value acceptance + property data

Freddie Mac ACE+ PDR

Freddie Mac ACE+ PDR

Services included:

Data collection service in all 50 states

360 room by room navigation tour

3D dollhouse

ANSI Compliant 2D floor plan with GLA

Fannie Mae value acceptance + property data

Freddie Mac ACE+ PDR

Submission to the GSE with submission results on the PDF

Desktop Appraisal

Services included:

Data collection service in all 50 states

360 room by room navigation tour

3D dollhouse

ANSI Compliant 2D floor plan with GLA

Basic Report

Fannie Mae value acceptance + property data

Freddie Mac ACE+ PDR

Freddie Mac ACE+ PDR

Services included:

Data collection service in all 50 states

360 room by room navigation tour

3D dollhouse

ANSI Compliant 2D floor plan with GLA

Fannie Mae value acceptance + property data

Freddie Mac ACE+ PDR

Submission to the GSE with submission results on the PDF

Accelerate your success with us today!

Give us a few details and we’ll follow up within 24 business hours

Frequently Asked Questions

What is Fannie Mae's value acceptance + property data and how can it benefit my lender clients?

The value acceptance + property data program is a new appraisal option offered by Fannie Mae that provides lenders with a more streamlined and cost-effective way to obtain property inspection data. By participating in the program, lenders can save time and money while still obtaining reliable property data to support loan origination.

How Does Fannie Mae's value acceptance + property data work?

This is a new option that utilizes property data collection by a verified vendor such as Asteroom. When a lender submits a subject property to the Desktop Underwriter® (DU) they will receive a message stating the property is eligible for this program. The lender or chosen appraisal management company will submit an order to a verified vendor to arrange for property data collection. This verified vendor collects interior and exterior data on the subject property to submit via API to Fannie Mae. After this has been successfully received Fannie Mae will validate the properties eligibility and notify the lender.

How does the value acceptance + property data differ from traditional appraisals?

With a value acceptance + property data process the appraiser isn’t involved. Instead a third party such as Asteroom will collect and provide property data to send to Fannie Mae via API. With this new process lenders will receive automatic value certainty with rep and warrant relief. A traditional appraisal, hybrid and desktop get value certainty and rep and warrant relief if the collateral underwriter score is 2.5 or lower. This process will help to bring increased efficiency and accuracy to the industry by standardizing data collection to help reduce cycle times and borrower costs.

What types of properties and loan transactions are eligible for the Fannie Mae’s value acceptance + property data?

The value acceptance offer will be considered on the transactions below:

- Loan casefiles that receive an Approve/Eligible recommendation

- One-unit properties, including condominiums

- Limited cash-out refinance transactions:

- Principal residences and second homes up to 90% LTV/CLTV

- Investment properties up to 75% LTV/CLTV

- Cash-out refinance transactions:

- Principal residences up to 70% LTV/CLTV

- Second homes and investment properties up to 60% LTV/CLTV

- Purchase transactions:

- Principal residences and second homes up to 80% LTV/CLTV

- Principal residences in “high-needs rural” locations identified by FHFA up to 97% LTV/105% CLTV (for borrowers at or below AMI), contingent on home property inspection

- Recently constructed property (i.e., new construction that is 100% complete) when there is an existing “as is” prior appraisal for the subject property

- The following are not eligible for a value acceptance offer:

- Texas 50(a)6 loans

- When the lender has any reason to believe an appraisal is warranted

- Construction and construction-to-permanent loans

- Two- to four-unit properties, cooperative units, and manufactured homes

- Transactions where either the purchase price or estimated value provided to DU® is $1,000,000 or more

- HomeStyle® Renovation and Homestyle Energy loans

- Leasehold properties

- Community land trust homes or other properties with resale price restrictions, which include loan casefiles using the Affordable LTV feature

- DU® loan casefiles that receive an ineligible recommendation

- Loans for which rental income from the subject property is used to qualify

- A transaction using a gift of equity

How can lenders and appraisal management companies take advantage of the value acceptance + property data, and what steps do they need to take to use it?

Appraisal management companies will need to help to educate their lenders on this if they have questions. They should ensure they have found a trusted provider who’s been verified by Fannie Mae to offer the property data such as Asteroom. Lenders should reach out to Fannie Mae with any questions or contact trusted industry advisors.

How does Fannie Mae ensure that the property value is accurate and reliable when using the value acceptance + property data?

Fannie Mae has run value acceptance + property data as a pilot program for the past 6 years. During that time they have accumulated 61 million appraisal reports. In combination with proprietary analytics from Collateral Underwriter® (CU®) they have determined the minimum level of required collateral due diligence. Companies that provide this data such as Asteroom have strict requirements on who can collect this data and how it’s verified. We have implemented advanced proprietary technology that enables our quality control team and processes to ensure complete accuracy and compliance.

What are the benefits of using the Fannie Mae’s value acceptance + property data for lenders and borrowers?

The main benefits as stated by Fannie Mae for this new option is “reduces cycle times and may reduce borrower costs, promotes safety and soundness by obtaining a current observation of the subject property, and provides operational simplicity and certainty at time of loan application.”

Are there any risks or downsides to using the value acceptance + property data?

One downside that might occur for lenders happens after the property data has been submitted to Fannie Mae via API from Asteroom. If the borrower changes the loan parameters and pushes the loan outside of the eligibility requirements. Then lender would typically need to do a full appraisal adding significant costs and delays. However, in this instance there will be an exception allowed in the new policy. The lender will have the option to do a hybrid appraisal.

How will the use of the value acceptance + property data impact the appraisal industry and appraisers?

Many in the industry aware of this program prior to it’s release and now have shared that they believe this will help pave the way for a better appraisal process. There are many reasons with the top being that this process will help to bring transparent standardized data that can objectively be utilized. This will help potentially reducing bias and as stated by Fannie Mae “provide operational simplicity along with certainly at time of loan application.”

What is Fannie Mae's value acceptance + property data and how can it benefit my lender clients?

The value acceptance + property data program is a new appraisal option offered by Fannie Mae that provides lenders with a more streamlined and cost-effective way to obtain property inspection data. By participating in the program, lenders can save time and money while still obtaining reliable property data to support loan origination.

How does Fannie Mae ensure that the property value is accurate and reliable when using the value acceptance + property data?

Fannie Mae has run value acceptance + property data as a pilot program for the past 6 years. During that time they have accumulated 61 million appraisal reports. In combination with proprietary analytics from Collateral Underwriter® (CU®) they have determined the minimum level of required collateral due diligence. Companies that provide this data such as Asteroom have strict requirements on who can collect this data and how it’s verified. We have implemented advanced proprietary technology that enables our quality control team and processes to ensure complete accuracy and compliance.

How Does Fannie Mae's value acceptance + property data work?

This is a new option that utilizes property data collection by a verified vendor such as Asteroom. When a lender submits a subject property to the Desktop Underwriter® (DU) they will receive a message stating the property is eligible for this program. The lender or chosen appraisal management company will submit an order to a verified vendor to arrange for property data collection. This verified vendor collects interior and exterior data on the subject property to submit via API to Fannie Mae. After this has been successfully received Fannie Mae will validate the properties eligibility and notify the lender.

What are the benefits of using the Fannie Mae’s value acceptance + property data for lenders and borrowers?

The main benefits as stated by Fannie Mae for this new option is “reduces cycle times and may reduce borrower costs, promotes safety and soundness by obtaining a current observation of the subject property, and provides operational simplicity and certainty at time of loan application.”

How does the value acceptance + property data differ from traditional appraisals?

With a value acceptance + property data process the appraiser isn’t involved. Instead a third party such as Asteroom will collect and provide property data to send to Fannie Mae via API. With this new process lenders will receive automatic value certainty with rep and warrant relief. A traditional appraisal, hybrid and desktop get value certainty and rep and warrant relief if the collateral underwriter score is 2.5 or lower. This process will help to bring increased efficiency and accuracy to the industry by standardizing data collection to help reduce cycle times and borrower costs.

Are there any risks or downsides to using the value acceptance + property data?

One downside that might occur for lenders happens after the property data has been submitted to Fannie Mae via API from Asteroom. If the borrower changes the loan parameters and pushes the loan outside of the eligibility requirements. Then lender would typically need to do a full appraisal adding significant costs and delays. However, in this instance there will be an exception allowed in the new policy. The lender will have the option to do a hybrid appraisal.

What types of properties and loan transactions are eligible for the Fannie Mae’s value acceptance + property data?

The value acceptance offer will be considered on the transactions below:

- Loan casefiles that receive an Approve/Eligible recommendation

- One-unit properties, including condominiums

- Limited cash-out refinance transactions:

- Principal residences and second homes up to 90% LTV/CLTV

- Investment properties up to 75% LTV/CLTV

- Cash-out refinance transactions:

- Principal residences up to 70% LTV/CLTV

- Second homes and investment properties up to 60% LTV/CLTV

- Purchase transactions:

- Principal residences and second homes up to 80% LTV/CLTV

- Principal residences in “high-needs rural” locations identified by FHFA up to 97% LTV/105% CLTV (for borrowers at or below AMI), contingent on home property inspection

- Recently constructed property (i.e., new construction that is 100% complete) when there is an existing “as is” prior appraisal for the subject property

- The following are not eligible for a value acceptance offer:

- Texas 50(a)6 loans

- When the lender has any reason to believe an appraisal is warranted

- Construction and construction-to-permanent loans

- Two- to four-unit properties, cooperative units, and manufactured homes

- Transactions where either the purchase price or estimated value provided to DU® is $1,000,000 or more

- HomeStyle® Renovation and Homestyle Energy loans

- Leasehold properties

- Community land trust homes or other properties with resale price restrictions, which include loan casefiles using the Affordable LTV feature

- DU® loan casefiles that receive an ineligible recommendation

- Loans for which rental income from the subject property is used to qualify

- A transaction using a gift of equity

How will the use of the value acceptance + property data impact the appraisal industry and appraisers?

Many in the industry aware of this program prior to it’s release and now have shared that they believe this will help pave the way for a better appraisal process. There are many reasons with the top being that this process will help to bring transparent standardized data that can objectively be utilized. This will help potentially reducing bias and as stated by Fannie Mae “provide operational simplicity along with certainly at time of loan application.”

How can lenders and appraisal management companies take advantage of the value acceptance + property data, and what steps do they need to take to use it?

Appraisal management companies will need to help to educate their lenders on this if they have questions. They should ensure they have found a trusted provider who’s been verified by Fannie Mae to offer the property data such as Asteroom. Lenders should reach out to Fannie Mae with any questions or contact trusted industry advisors.

BACK TO TOP

NEED HELP?

+1 (831) 298-6517

Monday-Friday: 9 AM – 4 PM PST

Copyright © 2026 Asteroom, Inc. All rights reserved.